Why budgeting makes a difference

Budgeting isn’t always fun. It takes effort and there is usually something more exciting to do with your time. However, the key to personal financial management is to be sure you’ve got money to pay your expenses and then have some of that fun you deserve. When you make a habit to budget every month, you are taking control instead of money controlling you.

If you’ve made financial mistakes (don’t feel bad, we’ve all done it), your debts may have gotten out of hand. This might come back to bite you when you need a loan for a vehicle, a house, or anything else you need to buy.

To ensure that you’re in command of your finances and getting back on track, here are some helpful budgeting tips for improving the gap between your income and expenses.

First, be sure to pay housing and utility bills on time and in full each month. These are the most crucial necessities for survival and are non-negotiable. Don’t put off paying them until it’s too late.

Second, avoid an excessive number of credit cards. You really don’t need more than one or two for auto payments and emergencies. You might think about destroying the ones you don’t use. If multiple debts have overwhelmed you, combining them into a single loan may alleviate stress and make the balance more manageable. You can then pay it off over time without incurring excessive interest charges.

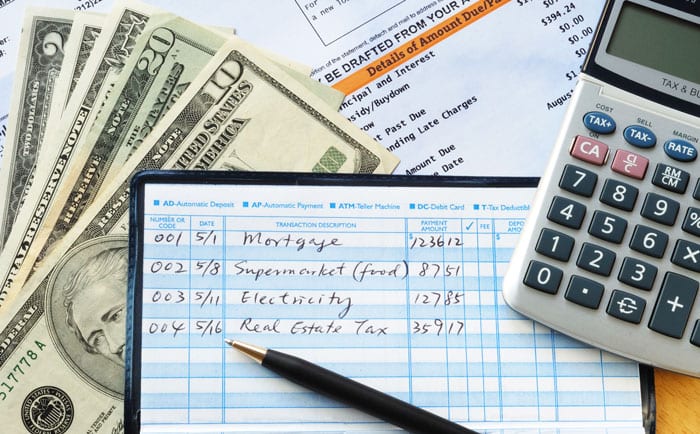

Finally, make a financial plan and write it down. If you’re not good with numbers, this can be challenging, which is why most people don’t even try. Without a budget, they end up in financial trouble.

Drawing a line down the middle of a piece of paper is a simple approach to starting your budget. Make a list of your after-tax household income on the left. Write down only the after-tax figure because you want to look at accessible income. If you’re comfortable with spreadsheets, download a free home budget template and fill in your information. Templates work well because the layout and formulas are already configured for you.

List the average of each monthly expense in the right column. Record your spontaneous or luxury shopping behaviors as well, such as eating out or impulse buying. Remember to include the payment of your credit cards and other loans as part of these amounts.

With this breakdown of your finances, look for opportunities to boost your revenue or lower your expenses. You’ll usually be able to accomplish a little bit of both. This difference is like the profit margin for a business. The bigger the spread, the better.

Although this process is quite simple, too many people avoid creating and keeping a budget. In reality, this practice frequently distinguishes between those who are financially successful and those who are not.

What’s keeping you from moving forward and doing it today?